Part 3: Embed Your Agent into Business Processes

In Parts 1 and 2, you built and configured an Accounts Receivable Agent that can investigate payment discrepancies, synthesize truth from multiple sources, and autonomously resolve validated claims. But a deployed agent sitting idle isn't providing business value. The real transformation happens when you embed that agent into your business processes—creating autonomous, event-driven financial workflows that operate continuously.

This is where the Integration Mindset and the Agentic Mindset come together beautifully.

Architectural Layers Working Together

In role-based agentic architecture, the Integration Mindset and Agentic Mindset are complementary, not conflicting:

The Integration Layer (The "Assembly Line"):

- Reliable, predictable, structured data flow

- Optimized for low latency and high throughput

- Handles real-time data streaming and transactions

- The Task: Execute high-speed data transformation and movement

The Reasoning Layer (The "Digital Colleague"):

- Flexible, goal-oriented autonomy

- Operates on the data flow, not in it

- The Role: Design, observe, and manage the data flow as an investigator, validator, or autonomous resolver

Your Accounts Receivable Agent operates in the Reasoning Layer—it investigates, validates, and decides what to do. But it doesn't sit in the critical path of high-speed payment processing flows. Instead, it's activated by events from the Integration Layer (bank deposits, customer emails) when its expertise is needed to resolve discrepancies.

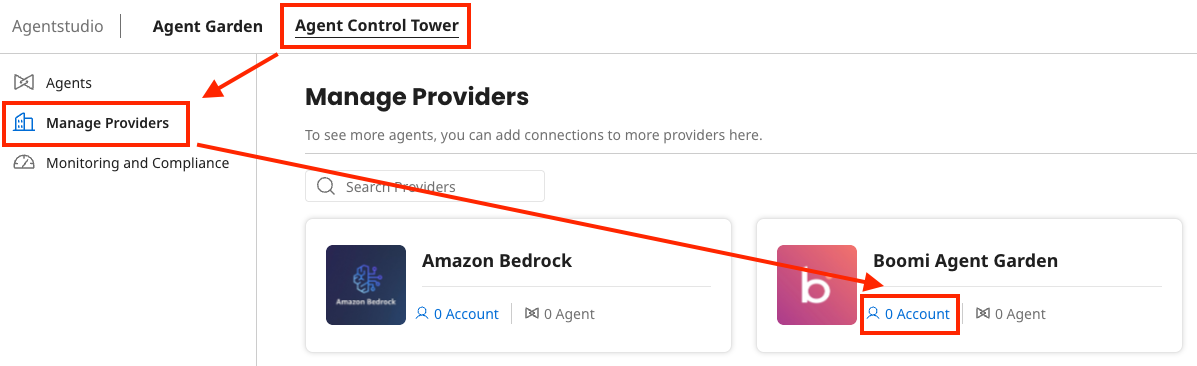

Configure Agent Control Tower

Before you can invoke your agent from an integration process, you need to add your Boomi account as an Agent Provider in Agent Control Tower.

-

Navigate to Agentstudio (if not already there).

-

Select Agent Control Tower from the left navigation menu.

-

Select Manage Providers on the left.

-

Select the Account link under Boomi Agent Garden.

-

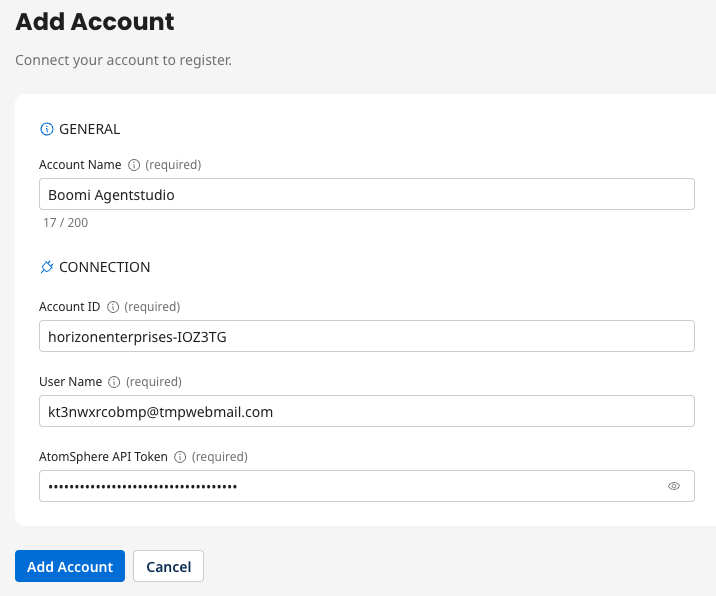

Select Add Account and populate the fields with the values you saved in the Prerequisites section:

- Account Name:

Boomi Agentstudio - Account ID: Enter Account ID from prerequisites

- User name: Enter your platform email address

- AtomSphere API Token: Enter Platform API Token from prerequisites

Account Synchronization

Account SynchronizationAfter adding your account it will synchronize momentarily. Your agents will display after the sync completes. You can continue with the next steps while the sync is in progress.

- Account Name:

Build the Integration Process

Now you'll build an integration process that activates your Accounts Receivable Agent when a payment discrepancy is detected.

-

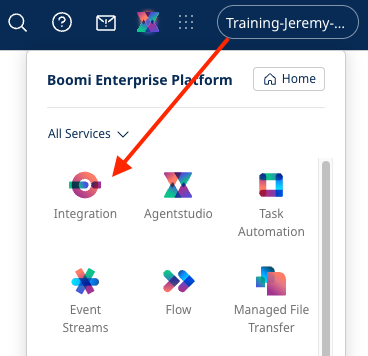

Click on the waffle menu (9 dots) at the top right of the screen.

-

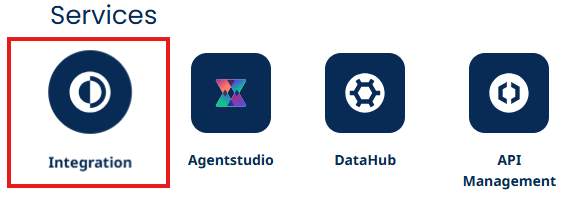

Click Integration.

-

Once in Integration, navigate to Build > Components.

-

Navigate to your working directory where you've been saving your components.

Finding Your DirectoryLook for a folder with your email prefix or initials where you've been saving your work throughout this lab.

-

Click on the three dots next to your folder name.

-

Click New Component.

-

Select Process in the modal dropdown.

-

Click Create.

-

Choose No Data in the right hand pane.

-

Click OK.

-

Click on New Process in the bar above the canvas.

-

Rename your process to:

[builderInitials] AR Reconciliation Automation

Add the Message Step

-

Click the + button on the canvas.

-

Search for and select a Message component.

-

Click on the newly created Message component to configure it.

-

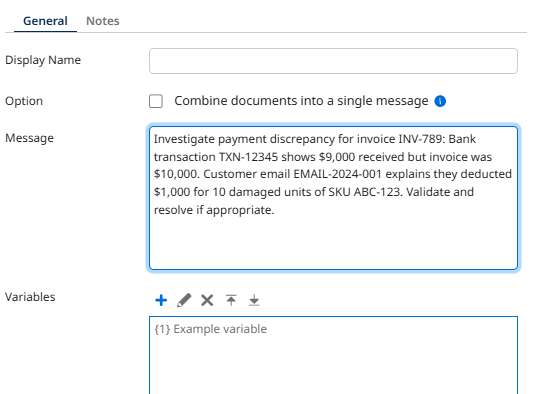

In the Body field, paste the test scenario from Part 2:

Investigate payment discrepancy for invoice INV-789: Bank transaction TXN-12345 shows $9,000 received but invoice was $10,000. Customer email EMAIL-2024-001 explains they deducted $1,000 for 10 damaged units of SKU ABC-123. Validate and resolve if appropriate. Event-Driven Activation in Practice

Event-Driven Activation in PracticeIn a production environment, this message would come from an event monitor watching your banking system API or email inbox. When a payment amount doesn't match an invoice total, or when a customer sends a remittance explanation, the event triggers this process and activates your agent.

This demonstrates asynchronous event correlation—your agent is activated by disconnected events (bank deposit + email) that need to be synthesized into a resolution.

-

Click OK.

Add the Agent Step

-

Click the + button on the canvas.

-

Search for and select Agent.

-

Click on the Agent component to configure it.

-

Click Generate Configuration.

-

Select your AR Reconciliation Agent [builderInitials] agent from the dropdown.

Agent Not Listed?If you don't see your agent listed, navigate to Agent Control Tower > Manage Providers. Find the Boomi account and click Sync Now to refresh the agent list.

-

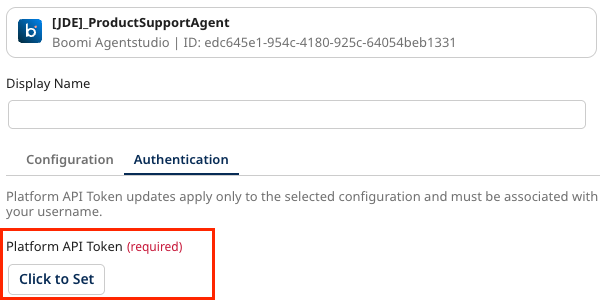

Click the Authentication tab.

-

In the Platform API Token field, paste your Platform API Token that you saved in the Prerequisites section.

-

Click OK.

Complete the Process

-

Click the + button on the canvas.

-

Search for and select End and Continue shape.

Your final process should look like this:

-

Click Save in the top right.

Test the Integration

Now let's test your integration to see the agent perform autonomous AR reconciliation within the business process.

-

Click Test in the top right.

-

Select your Agent Testing environment (or the Testing Runtime you created in Prerequisites).

-

Click OK.

-

Watch the process execute.

What to Watch ForAs the test runs, observe:

- The integration prepares the payment discrepancy details (Integration Layer)

- The Agent Step activates your AR Reconciliation Agent (handoff to Reasoning Layer)

- The agent investigates by calling Read Email Attachment, Get Bank Transaction, and Get Invoice Details

- The agent synthesizes the truth by correlating bank data + email data + invoice data

- The agent validates the customer claim against invoice line items

- The agent applies governance by checking the $2,500 threshold

- The agent resolves autonomously by creating a credit memo and posting the cash receipt

- The process completes with the agent's resolution summary (back to Integration Layer)

This is the two layers working in perfect harmony for autonomous financial operations!

View the Agent's Response

-

When the test completes, click on the End and Continue shape.

-

Click View Source Data to see the complete response from the agent.

-

In the Document Viewer, scroll down to locate the agent's response in the raw payload.

Understanding the ResponseThe agent returns a detailed response that includes:

- All tool calls the agent made (Read Email, Get Bank Transaction, Get Invoice Details, Create Credit Memo, Post Cash Receipt)

- The reasoning steps the agent took (investigation, validation, governance check, resolution)

- The final resolution summary including credit memo ID and GL posting confirmation

- Metadata about the execution including timestamps and decision points

This raw format contains ALL of the events from the agent (action, thinking, tool calls, financial transactions), similar to the trace log you reviewed in Part 2!

Look at What the Agent Did!Review the resolution the agent created. Notice how it:

- Investigated by gathering data from THREE disconnected sources (bank, email, ERP)

- Synthesized the truth by linking the $1,000 payment shortfall to the customer's damaged goods claim to the invoice line item for 10 units of SKU ABC-123

- Validated the claim by verifying that 10 units × $100/unit = $1,000 matched perfectly

- Applied governance by confirming $1,000 < $2,500 threshold and claim was fully documented

- Resolved autonomously by creating credit memo CM-456 and posting cash receipt CR-789

- Updated the general ledger to close invoice INV-789 with proper audit trail

- Provided complete transparency about its decision-making process

This is role-based financial intelligence delivering business value—transforming a manual, time-consuming investigation into an autonomous, instant resolution!

What You've Accomplished

Let's reflect on the transformation you've created:

Traditional Task-Based Approach (What You Replaced)

- Rigid payment matching logic flags any mismatch as an exception

- Creates disconnected exception records in multiple systems

- Requires human AR specialist to manually bridge the gap between bank data, email explanations, and invoice records

- Every discrepancy creates hours of manual investigation and verification

- Payment sits unapplied for days while waiting for human review

- No autonomous resolution—humans must create credit memos and post receipts manually

- High-volume exceptions overwhelm AR staff

Your Agentic Solution (What You Built)

- Truth synthesis: Automatically correlates asynchronous events from banking systems and email systems

- Unstructured data handling: Extracts meaning from PDF remittance advice without rigid parsers

- Intelligent validation: Cross-references customer claims against invoice line items through reasoning

- Governance-driven autonomy: Resolves validated claims under $2,500 autonomously, escalates others

- Complete financial transactions: Creates credit memos and posts cash receipts without human intervention

- Full audit compliance: Maintains detailed reasoning traces for every decision and action

- Event-driven operation: Works continuously, activating when payment discrepancies are detected

The Business Impact

Your Accounts Receivable Agent doesn't just flag exceptions—it transforms the AR workflow:

For AR Teams

- Focus on complex cases: Routine, validated discrepancies are handled automatically

- Reduced investigation time: No more manual correlation of bank data, emails, and invoices

- Consistent validation: Every claim is verified against actual invoice data using the same logic

- Eliminated manual entry: Credit memos and cash receipts are created and posted automatically

For Finance Operations

- Faster cash application: Payments are reconciled and posted within minutes, not days

- Improved DSO: Days Sales Outstanding decreases as cash is applied faster

- Better working capital visibility: Real-time GL updates provide accurate cash position

- Reduced exception backlog: 60%+ of routine discrepancies resolve autonomously

For the Business

- Scalability: Handle 10x the payment volume without hiring more AR staff

- Cost efficiency: Reduce payment resolution time by 70-85%

- Audit compliance: Full-trace observability and documented reasoning for every resolution

- Customer satisfaction: Faster confirmations and fewer follow-up inquiries

Architecting for Roles, Not Just Tasks

This lab demonstrated the fundamental shift in agentic architecture:

You started with the Integration Mindset:

- Building reliable "assembly lines" for data

- Predefined, rigid payment matching processes

- Task-focused exception flagging

You evolved to the Agentic Mindset:

- Designing autonomous "digital colleagues"

- Flexible, goal-oriented financial resolution

- Role-based investigation and validation

But you didn't abandon your integration skills—you elevated them! The Integration Layer still handles high-speed payment flows reliably. The Reasoning Layer adds intelligence, synthesis, and autonomous resolution on top. Together, they create systems that are both structured and adaptive.

The Art of the Possible

Now that you've built your first role-based financial agent, the possibilities are endless. Consider these extensions:

Expand the Agent's Role

- Add invoice dispute management capabilities for larger discrepancies

- Connect to freight/logistics APIs to validate shipping damage claims with carrier data

- Integrate with quality management systems to auto-create defect reports from damage claims

- Add multi-currency support for international payment reconciliation

- Include early payment discount validation and approval workflows

Connect to More Systems

- Trigger from banking APIs with real-time payment event streams

- Connect to SAP, Oracle Financials, NetSuite, or other ERP systems

- Integrate with email systems (Outlook, Gmail) for automatic remittance advice processing

- Link to document management systems for centralized remittance storage

- Connect to customer portals for self-service dispute submission

Add Intelligence

- Analyze resolution patterns to identify repeat offenders (damaged goods, pricing disputes)

- Generate reports on common deduction categories and amounts

- Predict payment behavior based on historical patterns

- Recommend supplier quality improvements based on damage claim trends

- Auto-escalate customers with unusual deduction patterns for fraud review

Build More Agents

- Order-to-Cash Agent: Handle the complete O2C cycle from order to payment reconciliation

- Credit Risk Agent: Monitor customer payment patterns and adjust credit limits autonomously

- Collections Agent: Identify overdue accounts and initiate appropriate collection workflows

- Financial Close Agent: Assist with period-end reconciliations and variance analysis

Each agent fills a role, not just a task. Together, they form a digital finance workforce that scales infinitely.

You've successfully built an Accounts Receivable Agent using the principles of role-based agentic architecture. Your agent doesn't just flag exceptions—it fills a role, synthesizes truth from multiple asynchronous sources, validates financial claims through reasoning, and autonomously resolves payment discrepancies within governance thresholds.

You've transformed a manual, time-consuming exception-handling process into an intelligent, event-driven financial workflow that operates 24/7—reducing resolution times from days to minutes, improving DSO, enhancing audit compliance, and empowering your human AR team to focus on what they do best: managing complex, high-value customer relationships and strategic financial decisions.

Welcome to the agentic era of finance. You're not just building automations—you're building colleagues with financial authority and reasoning intelligence, transforming a manual, error-prone process into intelligent automation that understands context, synthesizes information, and makes sound financial decisions autonomously!